New Movie “Buffaloed” Takes Aim at Collection Industry

There’s a new movie called Buffaloed that sets its sights on the debt collection industry. It portrays debt collectors as shady criminals who are willing to knock on doors, make nasty threats, and dupe the elderly into repeatedly paying off the same debt—anything to collect on the “paper” they have purchased from creditors. The movie concentrates on debt buyers that, according to the screenplay by Brian Sacca, purchase debt from banks and healthcare organizations that cannot afford to recover the past-due amounts themselves. However, Buffaloed plays it fast and loose with the facts about debt collection.

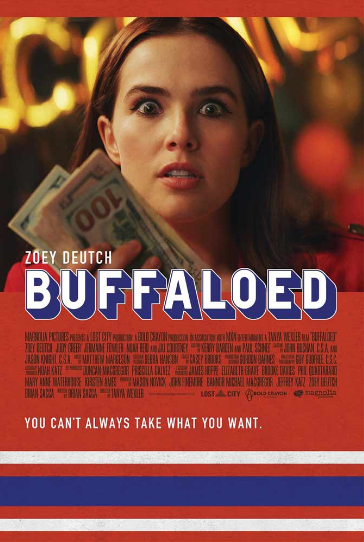

The story follows Peg (Zoey Deutch), an ambitious young woman determined to escape her lower-class roots and attend an Ivy League school. She carries out a series of scams to raise tuition money, and ultimately, she lands herself in prison for scalping counterfeit tickets. One day after her release, Peg receives a collection call and figures that she could do better than the representative on the phone. She goes down to the local collection agency, a boiler room run by a villain named Wizz (Jai Courtney), and gets a job. Her approach of “selling relief” to past-due consumers makes her a proficient collector, and she eventually decides to branch off and start an agency of her own. All sorts of unfriendly competition with Wizz ensues.

Buffaloed is an entertaining, often funny mix between I, Tonya and The Wolf of Wall Street, along with a touch of the financial exposé seen in The Big Short. But its portrait of the collection industry is poorly researched and often inaccurate, and it perpetuates negative and often outdated stereotypes about the current debt collection industry. Worse, it lumps all debt collection agencies into one bucket by barely differentiating between third-party agencies and debt buyers. There are vast distinctions to be made, however.

Debt collection agencies are third-party companies that creditors hire to collect debt on their behalf. These agencies, like IC System, answer to the original creditors and must be an outsourced extension of the creditor’s business office. In most cases, the original creditor wants to preserve the business relationship with the consumer. So the collection agency must approach debt collection with a positive consumer experience in mind.

Debt buyers, like the ones depicted in Buffaloed, purchase debts from creditors for a percentage of their original value; they can either collect on the purchased debt themselves or hire an outside agency to collect for them. The major difference is that after a debt buyer purchases a debt, the consumer no longer has the option of dealing with the original creditor. In other words, there’s no need to preserve the business relationship between the consumer and the creditor with friendly customer service.

Aside from Buffaloed lumping third-party companies and debt buyers together into the catch-all “debt collectors” label, the indie movie, directed by Tanya Wexler, furthers misconceptions about the collection industry.

Peg, who frequently speaks directly to the audience either in voiceover or by looking at the camera, explains, “There are barely any laws regulating debt collection.” This is a grossly inaccurate claim that ignores the existence of the Fair Debt Collection Practices Act, the Telephone Consumer Protection Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, or any number of other state laws and regulatory agencies that protect consumers against harassment or unethical behavior.

These laws regulate both third-party companies and debt buyers.

Peg also claims, “There aren’t enough resources to enforce the [laws] that do exist.” However, the Consumer Financial Protection Bureau (CFPB) was established by the U.S. government in 2011 to regulate and monitor how financial institutions, including debt collectors, treat consumers. There’s also a lively and litigious network of attorneys and law firms dedicating to suing collection agencies on the consumer’s behalf for violations of the above-stated laws.

The movie suggests that collection agencies can “garnish wages, revoke a license, put a lien on your house or business. And that’s just the legal stuff.” Most third-party collection agencies do not have these powers, unless the creditor or collection agency first sues, obtains a judgment, and then gets a court order. Moreover, most of the threats issued by the movie’s collectors are done so in an illegal fashion, using a harassing tone and manner that could easily result in a lawsuit.

Furthermore, many collection agencies these days have learned you can recover more with honey than with vinegar. If there’s one significant truth to the movie, it’s revealed when Peg becomes a better collector by diverting from Wizz’s unethical tactics. She discovers that active listening and empathy result in better recoveries. Of course, she eventually takes a downward spiral and becomes just as bad as Wizz, but as they say, that’s entertainment.

Doubtless, Sacca chose to ignore the highly regulated and consumer-friendly direction the collection industry has taken in the last decade because it’s more entertaining for the viewer. To be sure, watching the bad behavior of the movie’s debt collectors is fun; the reality of that behavior, however, is no laughing matter. There are debt buyers who care little for consumer satisfaction and give other, more consumer-focused debt collectors, and the entire industry, a bad name. Still, it’s important to distinguish between what the movie calls “a mob shakedown… backed by Wall Street” and the highly regulated and consumer-conscious side of the industry.

Buffaloed focuses on a small segment of the debt collection industry and is not representative of the whole. IC System was founded in 1938 on the principle of ethical debt collection, and that philosophy had guided the company for over 80 years of family-ownership, informing its Core Values of People, Integrity, Performance, Pride, and Innovation. That philosophy is also found in IC System’s BBB Accreditation and A+ rating, its status as a BBB Torch Awards for Ethics Finalist, as well as how the company measures what consumers think of its collection efforts.

Learn more about how IC System uses a Consumer Satisfaction Survey to ensure a respectful and professional tone on every collection call.

About the Author: Brian Eggert

Brian Eggert is a business development specialist and writer for IC System, one of the largest receivables management companies in the United States. With 18 years in the collection industry, Brian's experience includes operations, client service, proposal writing, blogging, content creation, and web development.